Scion's Q4 2021 Quarterly Portfolio: initial analysis of LiveWire, Bristol-myer squibb, General Dynamics, CVS Health, and Scynexis

Electric motorcycles, antifungal medications, and military spending. There was no shortage of interesting topics in Scion’s Q4 2021 portfolio.

This article provides a big picture view of Scion’s recent portfolio moves and then jumps into some analysis of the individual investments that Burry recently entered and exited. My research and analysis focuses on finding the non-obvious. The non-obviousness was strong in this quarter’s 13F.

My typical approach has been to wait until I’ve performed extensive research and analysis into an individual stock before I share my thoughts on a potential thesis. I’m taking a different approach with this article.

Instead of doing a single deep dive into a stock, I’ve provided the results of a sprint-style analysis for each position I’ve researched. My goal is to share a preliminary direction for my ongoing research into these positions and to get information in front of as many interested eyeballs as possible. The hope is that people with greater knowledge of one of these positions (e.g., you have experience working in or analyzing a particular industry/company) will provide some critique or additional information that could enhance my current direction.

Before hopping into the article content, I’ll share this tweet from Burry. The “laws, incentives, and politics” angle (which I refer to as the LIP strategy to save time) is more relevant now than ever.

Still Bearish on U.S. Equities

Burry's Q4 2021 portfolio is highly reminiscent of his Q3 2021 portfolio in terms of its overall bearishness on U.S. equities. You may recall that Burry pulled out of a large number of his Q2 2021 investments, even taking a loss in some cases.

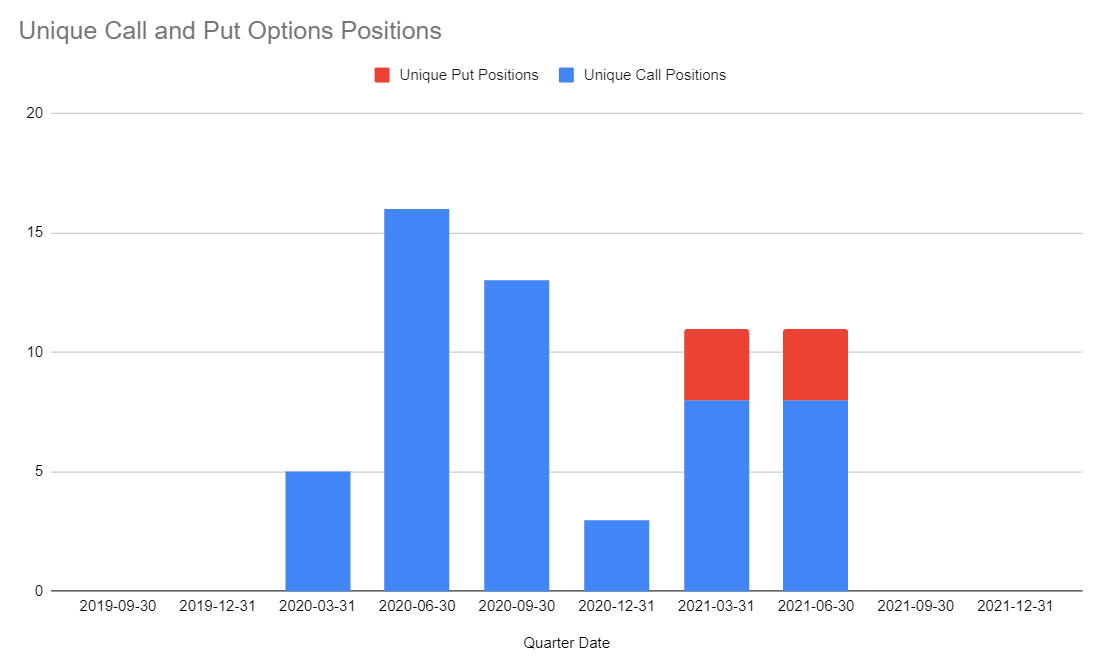

The graph below shows this change pretty clearly. Ignore the green bars. They represent an estimate of how much money he had invested in options contracts. Ultimately, we have no idea how much he has in contracts because we don’t know which contracts he bought and for what price. I tend to ignore them in some of my measurements as a result.

Focusing only on the blue bars, which represent the value of Scion’s shares-based positions, one can see that Scion had roughly ~$125M invested in U.S. equities during the four quarters following Q3 2020. The bearishness ramps up dramatically in Q3 2021 which is shown by the value of the shares-based positions dropping to roughly two-thirds of what it previously was (i.e., he went from $125M invested in US equities to $43M in a single quarter).

That number then jumps from $43M to around $73M which means it nearly doubled between Q3 and Q4 2021. While that sounds like an increase in bullishness, it is still roughly half of the overall amount invested in previous quarters.

Another similarity between Q3 and Q4 2021 is the lack of options-based positions. If you look at Scion's previous filings going back a few years, you'll see that they weren't investing in options positions until the pandemic triggered a market crash in March 2020. Note the absence of put options until March of 2021 when Scion started shorting Tesla and long-term U.S. treasuries via TBT call options and TLT put options. Fast forward a couple more quarters and Scion exited the options game entirely. This type of deleveraging is a move that superior investors make when they think a crash is on the horizon.

Where is the other $70M+ currently invested?

Not U.S. equities. If I had to speculate, I’d guess that he potentially rotated out of overpriced US stocks and into a mixture of international value/commodity-type stocks, short positions on US treasuries, and possibly even gold. None of these require reporting to the SEC and thus we wouldn’t hear about them via our usual source of information (SEC filings).

If you were watching his Twitter feed during Q4, you saw a few hints. This tweet was posted mid-Q4 and speaks for itself.

Another tweet in early October suggests that he’d been analyzing gold as a possible investment and didn’t much like what he was seeing in its modern behavior. There’s a sense of nostalgia in this one.

New Position: IMPX (LiveWire Electric Motorcycle SPAC)

To kick off the analysis of individual positions, I’ll start with IMPX. The reason is because it seems to be the position that has been capturing the most attention across the Burryology community. (Side note: for millennial readers and above, it’s LiVeWire, not LiMeWire. Uncanny resemblance, though.)

Some quick background: IMPX is the SPAC that is currently helping LiveWire—an Electric Motorcycle spin-off from Harley-Davidson—to go public. Once they’ve gone public, they’ll become the first public company that sells electric motorcycles. We’ve seen plenty of other EV SPACs in recent years. Some have done very well, some have not. If you are going to compare LiveWire to other EV SPACs, just make sure you’re comparing apples to apples. LiveWire already has a product and they are already selling it. Nikola, on the other hand, rolled a semi-truck down a hill, claimed they had a working product that they could bring to market, and investors bought that story. They are not the same thing.

To be clear, Harley is spinning off their electric motorcycle division but they aren’t trying to get rid of LiveWire. Instead, they are trying to create the illusion that LiveWire is a separate company from that of Harley-Davidson. This makes a lot of sense given the small overlap that exists between the demographic that would buy an electric motorcycle and the demographic that currently buys Harley-Davidson motorcycles. It is important to keep in mind that although Harley is trying to create this illusion of independence, they will still retain a majority share in LiveWire once it becomes its own company.

So far, the analysis I’ve read on this topic has focused on the idea that Burry is potentially playing the SPAC arbitrage game with IMPX. While that may play a part in his real thesis, my theory involves a more important story currently unfolding.

In my opinion, the investment in IMPX is another “laws, incentives, and politics” play that is masquerading as a potential meme stock/SPAC arbitrage play. As the chart for IMPX shows in the screenshot below, December 13th was an important date for the stock. First, and most importantly, they officially announced the merger.

Second, and just as important for the thesis, December 13th was the first trading day after several Senate committees released their revised portions of the Build Back Better bill on Saturday, December 11th. At least a few investors were watching the revisions coming out of the Committee on Finance. They liked what they saw.

The bill contains some potentially game-changing language in Section 126401: Refundable New Qualified Plug-in Electric Drive Motor Vehicle Credit for Individuals. It contains a subsection on “2- and 3-wheeled Plug-in Electric Vehicles” that is particularly relevant for electric motorcycle manufacturers and enthusiasts. For buyers of electric motorcycles, it provides a tax credit that is the lesser of 30% of the cost of the qualified 2- or 3-wheeled plug-in electric vehicle, or $7,500.

That’s a huge discount. It triples the previous incentive which was 10% off or $2,500 off, whichever is less.

If you dig into Harley’s experience with LiveWire thus far, you’ll find that they may have had some early difficulty in selling their electric bike. The sticking point appears to be the price that they originally listed it for. At ~$30,000, the LiveWire cost roughly $10K more than their competition who was selling a bike that was highly competitive with the LiveWire model.

Additionally, at $30,000, the LiveWire was very close in price to the Tesla Model 3. Unless you really, really wanted an electric Harley, you're probably going to choose the Model 3 to satisfy your electric vehicle needs.

Recently, a new model of the LiveWire came out named LiveWire One. The LiveWire One is apparently very similar to the original LiveWire but there is one huge difference: it costs about $21,000 (or ~$19,000 after the current tax credit). That’s a much better deal for an electric motorcycle.

It gets even better when you do the math using the new tax credit. Using the numbers from the current version of Biden's Build Back Better plan, the LiveWire One would cost roughly $15,900. That’s a pretty good deal considering you can get 146 miles of range on a single charge from a bike that charges to full capacity in 60 minutes.

If you recall, back in December, Manchin stood in the way of the bill after it had passed the house which caused the bill to be delayed into 2022. The fact that Burry had such a significant position in this company even after the Manchin blockade occurred could suggest that he thinks the e-motorcycle credit still has a shot at making it through into whatever bill Biden and Manchin renegotiate. In my opinion, the credit will lift all boats in the electric motorcycle market, sweeping LiveWire up with it.

Exited: CVS Health

This one was fun to watch.

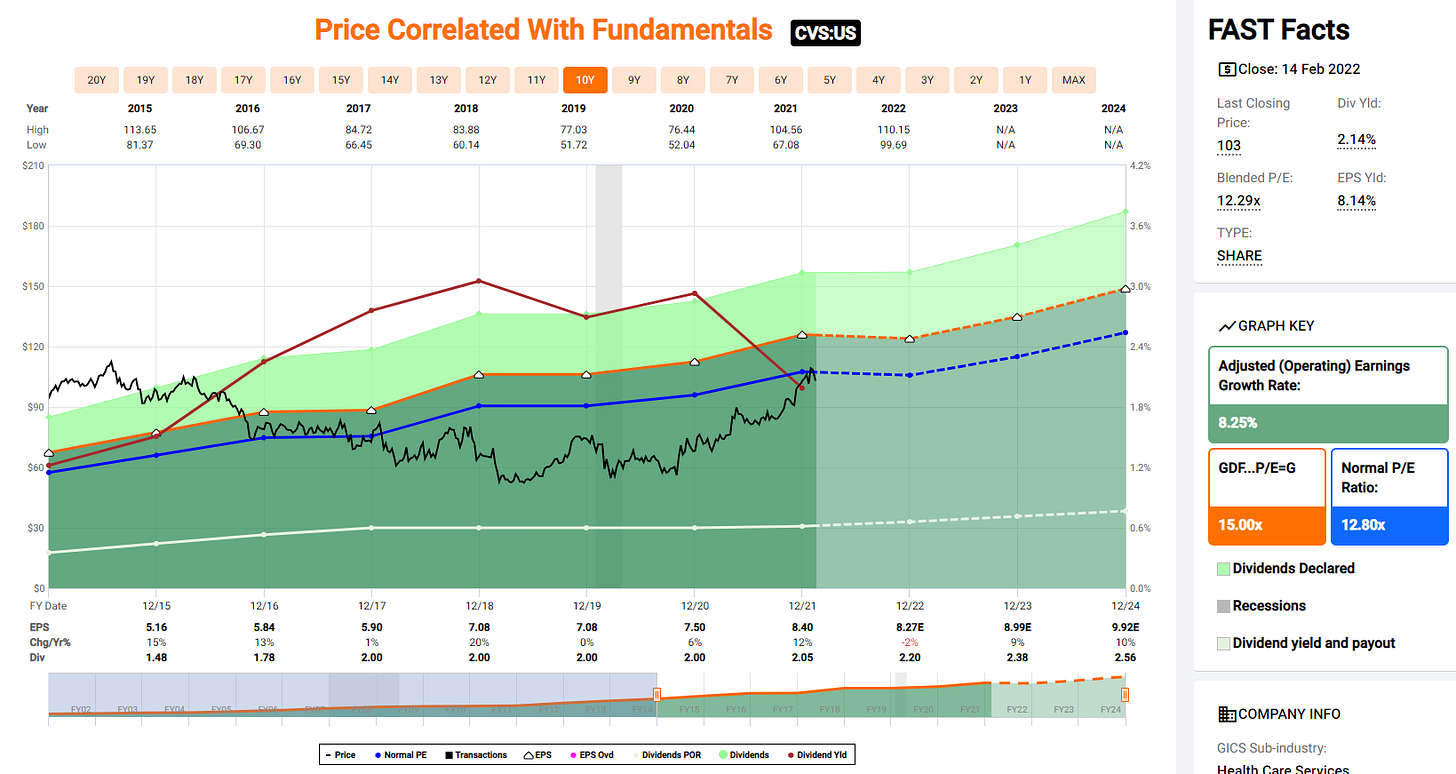

CVS has been a staple of Scion's portfolio since Q3 2020. I shared my theory on the CVS Health thesis in a Business Insider article published back in November 2021. The elevator story is that CVS froze their dividend increases and their buybacks following their massive acquisition of Aetna circa 2018. They had been increasing their dividends for nearly 20 years but had to pause those increases temporarily to pay down the debt that they had to take on to complete the acquisition.

Many people were predicting that they'd hit their target debt level some time in the first half of 2022, at which point they'd announce a resumption of dividend increases and share buybacks. The idea was that the stock would jump on that news—and that's exactly what happened. In December, CVS announced a $10B share buyback and an increase in its yearly dividend of 10%. This was on a faster timeline than many, including me, had been expecting.

At any rate, the stock climbed roughly 25% following that news. That put Burry’s investment solidly in the 30-40%+ gain territory and he closed the position as a result. There are plenty of other things to like about CVS Health; I was in it for the buybacks/dividend increase thesis and also exited following the news.

New Position: Bristol-myers squibb

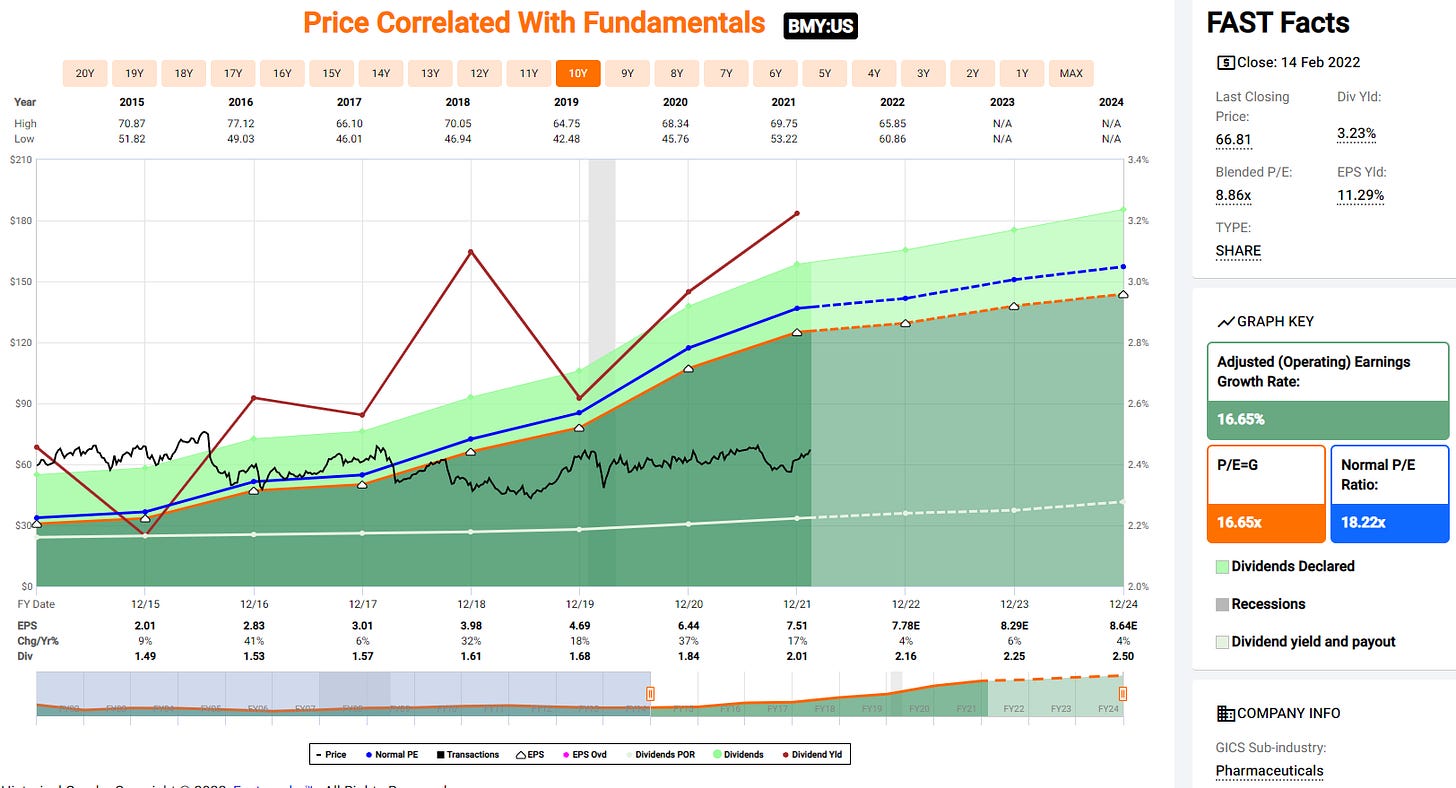

It's almost as if Scion was looking for a new significant play in the healthcare sector to replace their previous significant healthcare play (CVS Health). The pricing of Bristol-myers shares currently lags their fundamentals, especially when you compare them to competitors. Their price (black squiggly line below) currently trades at a blended P/E of ~9x which is well below its normal P/E of ~18x (blue flattish line).

Furthermore, earnings are still growing (green = growth rate). As they continue to grow, the price gets further and further away from where it should be. Eventually, I expect to see price normalize upwards as investors realize their previous bearishness was ill-founded.

I expect it to look something like what we saw with CVS Health (below). The price line crossed over the “normal P/E ratio” line back in 2016 going from overpriced to underpriced. The acquisition in 2018 and resulting freezes drove the price further away from the normal PE range through late 2020 (which just so happens to be when Burry first bought in). Shortly after that point, the price was pulled upwards towards the normal line. It went from a PE of 8x in late 2020 to 12.3x which it currently trades at today. BMY might currently be in the same spot that CVS Health found themselves circa Q4 2020.

The bearishness from investors seems to come from the current debt load they took on for a couple of large acquisitions over the past several years as well as the bleak outlook regarding the sustainability of future sales growth.

They have two blockbuster drugs ($1 billion+ in annual revenue per drug) and a sleuth of other smaller drugs expiring between 2022 and 2025. One of those blockbuster drugs is Revlimid. It was the fourth highest-selling drug globally (out of all drugs) in 2020 at somewhere around $12B in sales. It expires this year which means sales will fall as cheaper generics come online.

Overall, investors are expecting a decline of 30-40% in sales revenue from these patent expirations. While BMY management does not refute this, they also point out that they have 60+ other drugs in Phase 1 and 2 and another 10+ or so in Phase 3. That is a breathtakingly large pipeline. While these drugs will not necessarily be blockbusters like Revlimid, the collective group should be enough to shore up the revenue lost from the patent expirations.

This means that a company that is currently undervalued due to concerns over growth could actually continue growing with a revenue CAGR in the single digits between now and 2025. They also have massive cash flows and are paying down the aforementioned debt. Their stock chart shows a recent reversal from a primary downtrend that ran from August to December 2021 to a primary uptrend that’s been going since December. Perhaps the price will catch back up to the company's fundamentals over the next year or two as we saw with CVS Health.

Exited: Scynexis

I was expecting Burry to close this position for the same topical reason that he exited CVS Health—he hit his 30-40%+ gain threshold and sold everything. There is an important difference between the CVS Health exit and the Scynexis exit. In the case of CVS Health, the thesis played out according to plan. It makes plenty of sense to pat yourself on the back and take your winnings off the table.

For Scynexis, however, the story ain’t over. The thesis hasn’t finished playing out. Burry netted a large gain on Scynexis due to the “Burry bounce” that he himself triggered by simply investing in the stock. This is the same effect that Warren Buffett has—when he invests in a company, investors flock to it, causing an early spike in the price that levels out later. There has to be a psychological descriptor for this investor behavior but I’ve yet to find one. That’s why I’ve started using the term, “Burry bounce”. You can see the Burry bounce in the screenshot below. It starts on November 15th and continues for several weeks.

The Scynexis thesis is HIGHLY non-obvious. It is another LIP-style investment. One of the primary components of the thesis involves a bill called the PASTEUR Act. If the PASTEUR Act gets signed into law, it will create a new market paradigm for companies focused on treating infection caused by antimicrobial drug-resistant superbugs. There's a broken market for drugs that treat these infections and several companies have gone bankrupt as a result. The government wants to fix that by granting $750,000,000 - $3,000,000,000 subscription contracts that would pay out over something like a 10-year period. These contracts “delink” the payment incentive from the sales volumes of the medications. I’ve written about this extensively in my Laws, Politics, Incentives, and Superbugs post from earlier this month.

When Burry bought the initial position, the company was also on its way to commercializing its only medication—ibrexafungerp. Ibrexafungerp has had slow and steady sales since its commercialization date in August 2021. But, ibrexafungerp isn't the whole thesis. It's just what makes Scynexis more attractive than the other antifungal/antibacterial companies who will also be eligible for government grants under the PASTEUR Act. I haven’t seen any published analysis linking Scynexis to this bill which means that there aren’t many folks watching it, except Burry, that is.

The most recent status of the PASTEUR Act is that it is currently contained in the Cures 2.0 bill which was recently linked to the high priority ARPA-H bill by the chairwoman of the health subcommittee of the House Committee on Energy & Commerce. She is working to advance both bills to a vote by the House of Representatives as soon as possible. This is important because ARPA-H is a top priority for Biden who cares deeply about his moonshot cancer initiative (his 46 year old son died from cancer not too long ago). With these bills traveling together, a vote against the PASTEUR Act would be a vote against ARPA-H and the moonshot initiative. Isn’t that ultimately just a vote against curing cancer?

As long as the PASTEUR Act is still alive and moving through the legislative process, the Scynexis thesis is also still alive.

Swapping Defense Contractors: Replacing Lockheed Martin with General Dynamics

This one is quite the puzzle and is not something I expect to crack in under 24 hours. What I will suggest is that Burry may have decided to swap LMT for GD because he found something more attractive about GD and their status in the defense contracting sector. My current line of investigation (and I'd love to hear from people who know the defense contracting space because I don't) hinges on the idea that Burry's military play changed based on one or more of these factors:

information in the National Defense Authorization Act of 2021 (signed by Biden on December 27th, 2021)

a greater focus on the Russia/Ukraine conflict (this technically wasn't front-and-center until early January and seems less likely)

new information on the deficiencies in the military strategies of Taiwan and/or the US in the event of a Chinese invasion (U.S. wargames have taught us a lot about where we fall short)

strong gulfstream jet demand on top of strong military demand from an increasingly militaristic planet

I'm exploring all of these paths as I think the answer probably has to do with a change in legislation that makes one or more of General Dynamics products highly desirable due to a deficiency in the ability of the U.S. to succeed in a fight against China or due to the arming of countries in Europe as they shore up their defenses against a possible war with Russia.

Poland buying several billion dollars worth of M1A2 Abrams tanks is one example of what could be many "military refreshes" coming out of Europe and other countries as global tensions escalate. Global Dynamics has reported "increased demands signals" from the Czech Republic, Romania, Denmark, Switzerland, and Spain as well as the Middle East. They also excel at nuclear submarines and a war with China could rely heavily on a submarine-based attack strategy.

If you are aware of high quality strategic analysis on US military deficiencies, please share your sources with me!

I’m tracking these bills as they travel through the legislative process and will be posting updates on their progress on my Twitter account. Feel free to follow me there if you’re interested in updates as they happen.

Disclaimer: I’m not a financial advisor and this is not financial advice. Everything I’ve shared is my opinion based on the research and analysis I’ve performed.